Understanding Catalysts in Stock Market Analysis

Disclaimer: This is not investment advice. The following article is based on the premise that a catalyst in stock trading refers to any event that instigates a significant move in the price of a stock during a specific time horizon.

If you want to automatically filter Catalysts for a chosen stock and see the news of that day to understand what moves a certain company's stock price , check out Catalyst Screener.

Macro Catalysts

Macro catalysts encompass broader factors that affect the stock market and can cause significant price shifts. Predicting the impact of macro catalysts can be challenging due to the multitude of variables involved.

Macro catalysts often include:

Data Releases and Meetings: These can include meetings such as the Federal Open Market Committee (FOMC) or Jackson Hole Economic Symposium, or data releases such as the Consumer Price Index (CPI), retail sales data, and the ISM Manufacturing Index. These events often trigger market reactions as they provide insights into the economic health of a nation.

Black Swan Events: These are unpredictable events with potentially severe consequences, such as a pandemic or war. The term "black swan" comes from an ancient saying that presumed black swans did not exist – a saying that was reinterpreted to teach a different lesson after black swans were discovered in the wild.

Theme Catalysts

Theme catalysts are trends or developments that affect various industries or sectors within the stock market. Traders often generate investment ideas based on these themes and search for catalysts within the theme that could potentially impact stock prices.

Examples of theme catalysts include the adoption of 5G and fiber technology, growth in solar energy use, increased infrastructure spending, the rise of electric vehicles, and any supply/demand imbalances in a sector or industry.

Industry Catalysts

Industry catalysts are narrower than themes and can be more date-specific, providing potentially more reliable indications of stock price movements. They include:

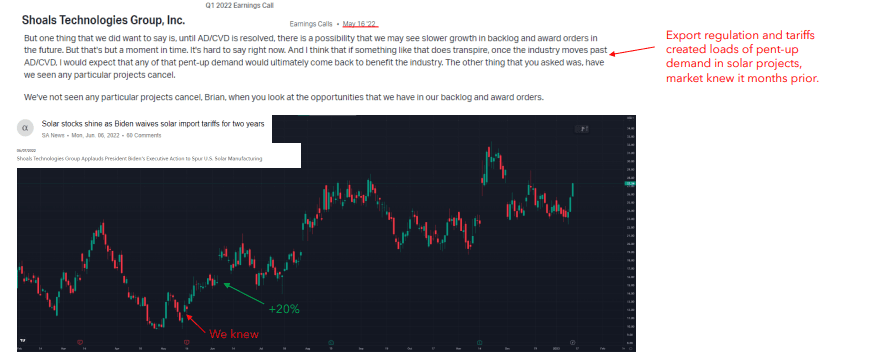

Peer Reports: The financial results of peer companies can impact the stock prices of other companies within the same industry.

Industry News: Important news or developments within an industry can have widespread effects on stocks within that industry.

Industry Analyst Activity: Analyst upgrades, downgrades, and notes can drive stock price movements as they influence investor sentiment and expectations.

Earnings Catalysts

Earnings releases are unique in that they are catalysts themselves but also contain a variety of smaller catalysts. While the headline numbers are important, other factors in the release can often have a greater impact on the stock price. These can include:

Significant Earnings Beats or Misses: These can move a stock price depending on what's priced in. The concept of "buy the rumor, sell the news" can play out here.

Vital KPI Expectations: Beating or missing key performance indicator expectations can have a strong impact on stock prices.

Guidance: If the company's guidance significantly differs from market expectations, this can lead to large price moves.

Commentary and Keywords: The tone of management commentary during earnings calls can significantly influence investor sentiment and, consequently, the stock price.

Business Catalysts

These are company-specific catalysts that may not be related to earnings. They include product releases, regulatory approvals, acquisitions, expansions or investments, divestments, activist investor activity, insider buying or selling, management changes, and capital raises.

In summary, understanding various types of catalysts can greatly aid in predicting potential stock price movements. Whether macro or micro, industry-wide or company-specific, each type of catalyst offers unique insights and opportunities to traders. However, it's crucial to remember that stock trading involves risks, and one should always carry out thorough research and consider multiple factors before making any investment decisions.